Priority Method

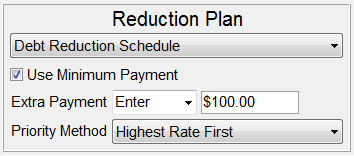

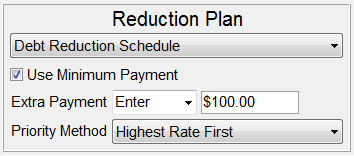

The priority method is only available if the reduction plan is set to the debt elimination schedule. This determines the order in which the debts are paid off. Choose from the drop down list, as shown in the image below, one of 10 predefined priorities or select the User Specified option to manually prioritize each debt.

Debt Analyzer window

Priority Methods

Below is a brief description of each priority method available.

Highest Rate First

The debts with the highest interest rates are paid off first.

Smallest Debt First

The debts with the smallest balance are paid off first.

Largest Debt First

The debts with the largest balance are paid off first.

Smallest Minimum Payment First

The debts with the smallest minimum payment are paid off first.

Largest Minimum Payment First

The debts with the largest minimum payment are paid off first.

Smallest Current Payment First

The debts with the smallest current payment are paid off first.

Largest Current Payment First

The debts with the largest current payment are paid off first.

Shortest Term Debt First

Under the current conditions, the program determines how long it will take to pay off each debt given the payment, balance and interest rate. Those debts which normally take the shortest time to be paid off are given the highest priority to be paid off first.

Longest Term Debt First

Under the current conditions, the program determines how long it will take to pay off each debt given the payment, balance and interest rate. Those debts which normally take the longest time to be paid off are given the highest priority to be paid off first.

Disperse Extra Funds Equally

All debts receive an equal portion of any extra funds that are available.

User Specified

You select the order in which the debts are to be paid off. When using this option the Priority field in the Enter Debt Information window is enabled so that the priority preference may be selected.

Strategies

In many cases, the priority payoff option will simply be a matter of preference. However, certain options offer either real or psychological advantages. The Highest Rate First should always yield the best results in terms of the amount of interest saved. Simply put, the debts with higher rates are going to cost more -- so the sooner they are paid off, the better.

Many people advocate paying off the smallest debts first (select Smallest Debt First or Shortest Term Debt First). The number of debts will begin to disappear quicker giving the feeling that the goal is being accomplished -- Getting out of Debt! This satisfaction may be well worth the few extra dollars paid in interest by not following the Highest Rate First method.