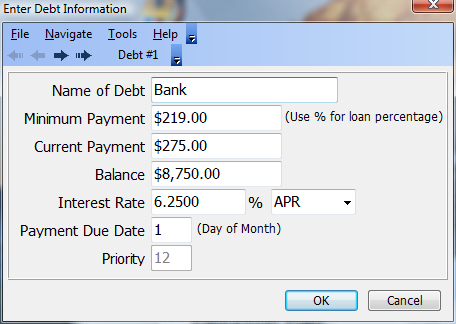

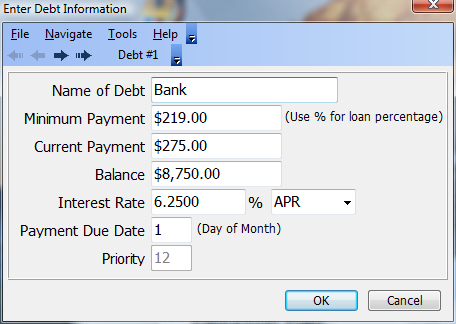

Enter Debt Information

Use the debt entry window to enter all the information about each debt. Enter the name of the debt, the minimum payment, the current payment being made on the debt, the current debt balance and the interest rate.

Note: Optionally specify the minimum payment as a percentage of the loan. Simply enter a "%" after the number. Up to 50 debts may be entered.

Debt Analyzer > Debts > Add Debt or click on the Add button

Name of Debt

Assign a name to the debt to later help identify the debt. This may include any number of loan types -- a credit card, a bank loan, a car loan or even a mortgage.

Minimum Payment

Enter the minimum payment that is required on the debt. This may be expressed as a percentage of the debt by simply entering a percent sign (%) after the number.

Current Payment

Insert the actual current payment being made on the debt.

Balance

Enter the current loan balance. It is the amount that is currently owed on the debt.

Interest Rate

This is the interest rate being paid on the debt. Interest rates can be calculated in several ways and vary from credit cards, bank loans, car loans, etc. Note: The interest rate should always be entered as a percentage.

Debt Analyzer provides an option to specify the type of interest rate to be applied to the debt. Use the drop down menu to choose from APR, Effective, Monthly and Daily rate calculations. Each rate type is explained below.

APR & Effective

APR refers to the "Annual Percentage Rate". This rate is used by simply dividing it by 12 and using the result as a monthly factor. However, because this monthly factor gets compounded 12 times during the year, the actual interest rate paid is higher. This higher actual rate is called the "Effective Rate".

For example, if the APR is 18%, then the effective rate would be 19.5618% which is the 18% divided by 12 and compounded 12 times during the year. Most credit cards specify their interest rate in terms of the APR.

Monthly

The Monthly Rate is simply the APR divided by 12 and is sometimes used with credit cards.

Make sure that the value is entered as a percentage. For example, a loan with a 7.5% APR should be entered into Debt Analyzer as 0.625. This monthly rate is calculated by dividing 7.5, the interest rate percentage, by 12, the number of months in a year. However, a credit card statement may show this as 0.00625. If so, multiply the periodic rate shown by 100 to get the daily percentage rate.

Daily

The Daily Rate is an amount that is applied each day. This is another method used to calculate interest for some credit cards and loans. More interest is charged in months with 31 days than in months with 30 days. Debt Analyzer calculates the interest due for the month based on the number of days in the month. All the other interest rate methods listed above treat each month equally when it comes to computing interest.

This rate is sometimes listed on a credit card or loan statement as the Daily Periodic Rate. However the Daily Periodic Rate shown may or may not be a percentage. Make sure to enter the value as a percentage. For example, a loan with a 7.5% APR should be entered into Debt Analyzer as 0.021233. This daily rate is calculated by dividing 7.5, the interest rate percentage, by 365, the number of days in a year. The statement may show this as 0.00021233. If so, multiply the periodic rate shown by 100 to get the daily percentage rate.

Payment Due Date

This is the day of the month that the payment of the Debt is to be received by the creditor. The payment due date only applies to the Debt Elimination strategy and not to the Loan Consolidation. It is used only if "Daily" type reports are desired.

Priority

The priority is the order in which the debts receive any extra funds. The priority only applies to the Debt Elimination strategy and not to the Loan Consolidation. Unless the priority method is set at "User Defined", the priority cannot be changed and is determined automatically by the program.

OK

Once all debt information has been entered, press the OK button to save the data and return to the Main Window. The changes are displayed in the Debt List Box.