Debt Reduction Schedule

The Debt Reduction Schedule is designed to take the current debt information and project a possible solution for eliminating the debt. The solutions generally show significant savings in interest (interest that does not go to the creditor) by following the schedule instead of merely making the same current payments.

How does it work?

Each debt is given a payoff priority. Every month, payments are made to each debt. Once one debt is completely paid off, the payment that was earmarked for the retired debt is then applied towards the highest priority debt. This process accelerates repayment of the highest priority debt. Loan acceleration (early payoff of a loan) is what produces the interest savings.

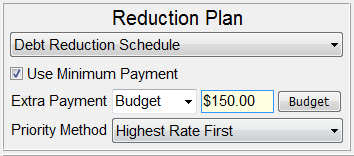

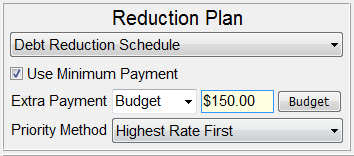

To sum up -- as debts are paid off, the payments for those debts are applied to the highest priority debts that have not been repaid. Several options are available which can help accelerate and optimize the debt elimination schedule. These include using Minimum Payments, applying Extra Payments and selecting a Priority Method. Other options include Set Budget and Variable Payments.

Debt Analyzer Window