Tutorial - Debt Manipulation

In this tutorial, we will explore the single debt manipulation feature. This option examines a single debt and displays the effects of changing the monthly payment amount or payoff date. It is necessary to complete the first tutorial - Enter Debt Information - before continuing with this tutorial.

Select a Debt

Open the Debt Analyzer window. The window should display the three debts created in the first tutorial. If not, click on File | Open Plan and load in the Tutorial plan we created in the previous tutorial. Highlight the first debt - Credit Card. Click on the Calc button at the bottom of the window to open the Debt Manipulation window.

Manipulate the Debt

We will experiment with this credit card debt. Currently it would take over 13 years to pay off this debt, if only paying the minimum of $30.00 per month. Interest expense of $2,385.93 would be paid, in addition to the $1,750 principal amount.

Alter Payment

In the Alter Payment section, insert 50.00 in the Current Payment field. This shows the effect of paying $50.00 per month instead of $30.00.

Alter Duration

In the Alter Duration section, insert 60 in the Months in Loan field. This shows the monthly payment necessary to pay off the debt in 60 months (5 years), instead of over 11 years.

See the Results

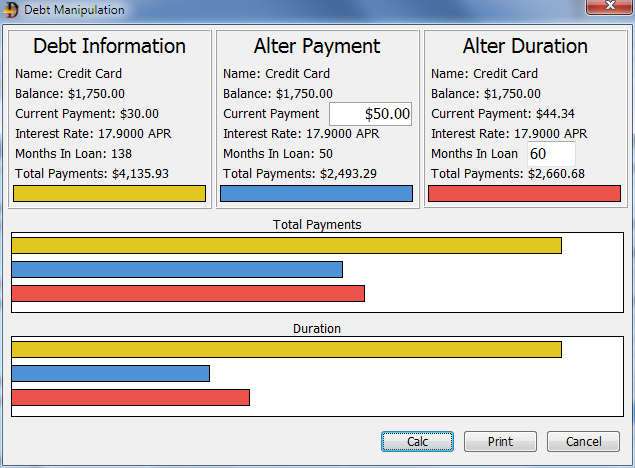

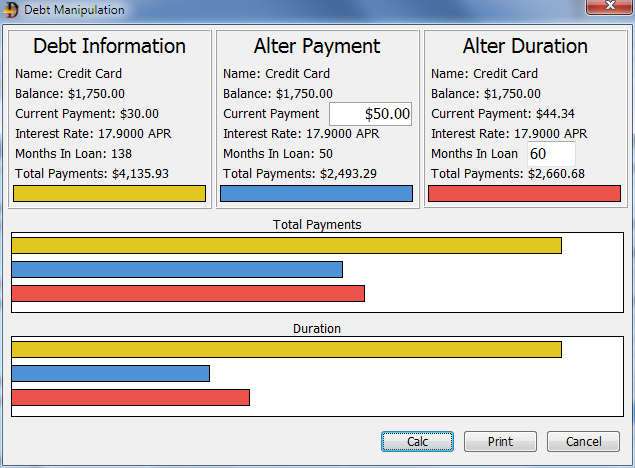

Click on the Calc button to see the new calculations. The Enter Debt Information window should look like the following.

As shown in this example, paying an additional $20.00 a month reduces the payoff schedule by 88 months (over 7 years) and saves $1,642.64 in interest. Or by increasing payments $14.34 per month (in order to pay the debt off in five years), the debt is paid off 78 months earlier and saves $1,475.25 in interest.

The bar graphs show a visual representation of dollar payments or time necessary to pay off the loan.

Experiment by entering a different current payment or months in loan to see the effects. When finished, click on the Cancel button to return to the Debt Analyzer window. Or click on Print to print a copy of this window.