The Loan Consolidation Schedule is designed to take all of the current debts and combine them into a single new loan.

How does it work? The new consolidated loan is presumed to have a lower overall interest rate than the combined existing debts. It is the lower interest rate that makes loan consolidation so appealing -- it results in lower overall payments and less interest paid on the loan.

Credit cards typically have high interest rates associated with them while Bank or Credit Union loans usually have much lower rates. It is therefore relatively simple to take all the credit cards balances, add them up, get a new loan from a bank, and pay off the credit cards. The bank loan saves money through interest savings. Debt Analyzer creates loan consolidation schedules and determines the potential savings.

Note: A loan consolidation is relatively simple to do. But the temptation is there to start using the credit cards again. If not careful, the credit card balances could return in addition to now having a sizable loan consolidation debt to repay. Use loan consolidations with caution!

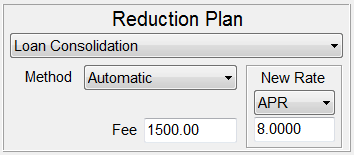

Several options are available to tailor the loan consolidation to specific needs. These options are made available through the loan consolidation method input field. Depending on the method selected, enter a new monthly payment or the number of months in the new loan.

Debt Analyzer > Debt Reduction Schedule drop down list

Method

When consolidating a loan, choose the automatic method or specify either the amount to pay monthly on the new loan or the number of months to pay on the new loan.